Take Advantage of Special Financing And Incentives in 2026

Tax Credit Baked In

Pricing reflects the federal incentive value captured by our partner so you typically pay about 70% of the system cost upfront.

Up to $8,500 Utility Incentive

Qualify for up to $8,500 when installing a solar system with energy storage back up system.

Financing Options

You can finance your solar installation with low monthly installments through our finance partners or through a mortgage when building a new home.

Why 2026 is different

2026 brings a major shift in how homeowners access solar incentives. The 30% Residential Federal Tax Credit that applied when you owned your system expires for systems placed in service before December 31, 2025. This means homeowners can no longer directly claim this credit on their personal tax return for new installations completed after that date.

At Good Faith Energy, we stay ahead of these changes so our customers do not miss out on real solar savings. Innovative solutions like Power Purchase Agreements (PPAs) and prepaid solar lease or PPA arrangements now provide new paths to benefit from federal tax incentives while still enjoying cleaner, lower-cost solar energy. With these options, the tax credit value is built into the system structure and passed on through reduced energy costs, predictable pricing, and long-term savings.

Saving & Rate Protection

Rather than being at the mercy of fluctuating energy costs, you can save money on your monthly bills with solar!

Going Green With Solar

Solar energy is an environmentally friendly power source that can bring us all one step closer to a sustainable future.

Energy Resilience & Independence

Instead of losing power during a blackout, you’ll enjoy constant, reliable power with solar energy. We also have warranties available.

Equity and Ownership

Solar panels can add value and curb appeal to any property, making them a wise investment.

How Prepaid Solar PPAs Work

Prepaid solar Power Purchase Agreements provide a way for homeowners to go solar in 2026 while still benefiting from federal incentive value through a third-party structure.

- A solar partner installs the system on your home and maintains ownership during the initial term.

- You make a large upfront payment, usually covering about 70% of the total system cost, either in cash or through financing.

- The third-party owner claims the available federal solar tax incentive and factors that value directly into your system pricing.

- Your solar system produces energy at a predictable rate while monitoring, performance, and maintenance are handled for you.

- After the federal tax credit recapture period, typically six years, the system can often be transferred into your ownership.

- Once ownership transfers, you receive the full benefit of the system without ongoing payments.

This allows homeowners to reduce upfront solar costs and access incentive value even though direct homeowner tax credits are no longer available in 2026.

Important Solar Incentive Update for 2026

The homeowner-claimed federal tax credit expires for systems placed in service after December 31, 2025. If you want that credit on your tax return, you must complete installation before that deadline.

But you can still access third-party incentive savings through PPAs and similar structures available into 2027 and beyond

Texas Local Incentives

- 100% Solar Property Tax Exemption – Texas law exempts the added value of a solar system from property taxes, providing ongoing value protection for homeowners.

Looking Forward

Discover how Good Faith Energy is offering homeowners an innovative path to solar savings. You pay 70% upfront and gain full system use today while our partner captures the 30% tax benefit for you. Savings don’t have to wait. Learn how to take advantage of this opportunity now.

Let Us Bring Solar to Your Home in 5 Easy Steps

- Aerial Imagery & Bill Analysis: We’ll analyze your energy usage and how much sunlight your home receives. Next, we’ll survey your home using drone scans to create a project proposal.

- Load Analysis for Backup Power: If you’re interested in home battery backups, our engineers will determine how many batteries you’ll require using CAD software to create a rendering.

- Customized Financial Solution: Finance your system on a plan that works for you with help from our ethical sales team. Many systems can be financed over 25 years with no money down, and you can enjoy the benefits of tax credits.

- Professional Solar Installation: Our team will get to work on installing your solar panels, taking care of any HOA, city, and utility permits. From scheduling to the final inspections, we have it covered.

- Enjoy the Benefits of Solar: Enjoy all the benefits of going solar with clean, sustainable energy at your fingertips. And if you ever need our dedicated service team, Good Faith Energy is just a phone call away.

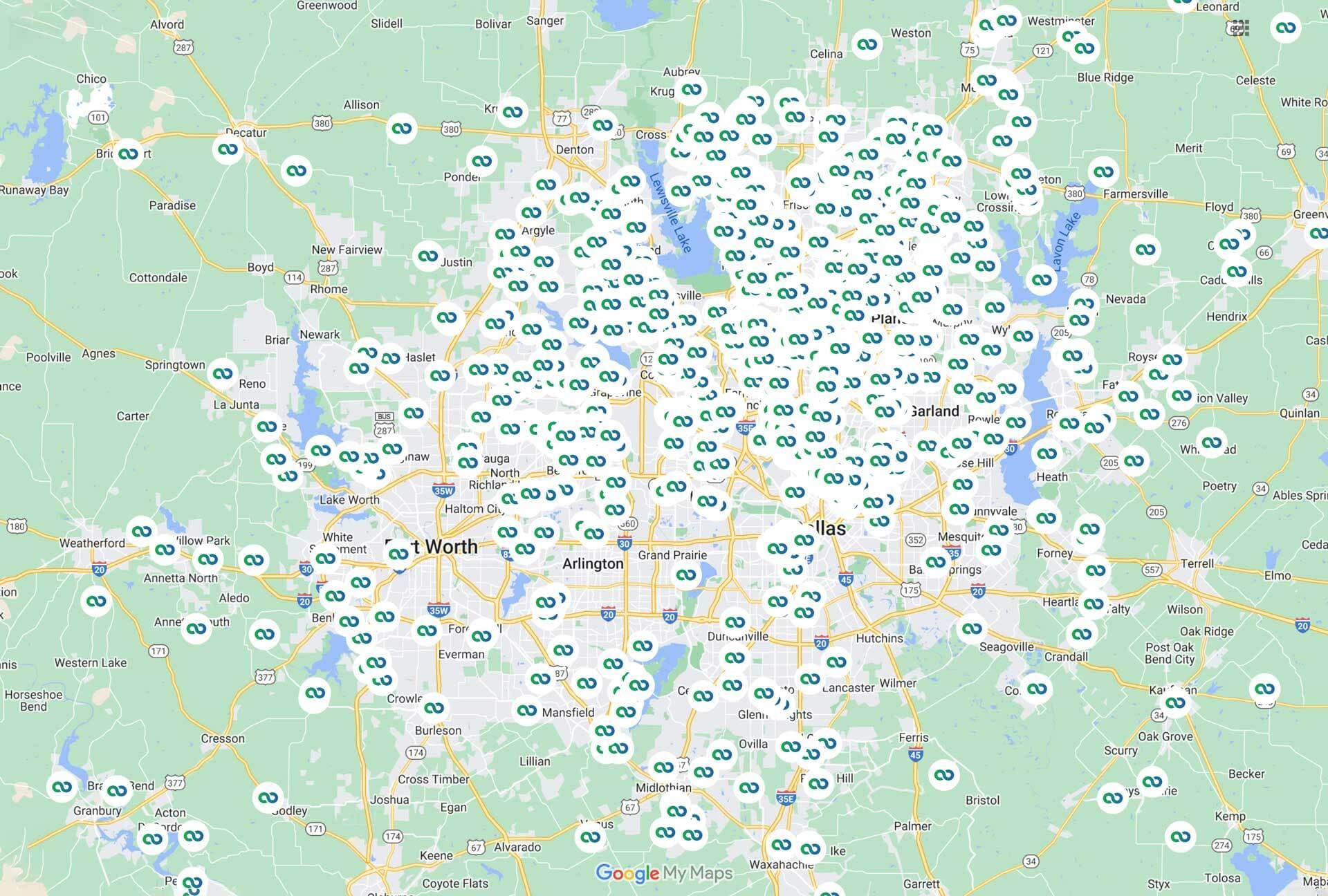

Get A Personalized Solar System Quote

Learn more about how Good Faith Energy can help you and how you can make the most of current tax incentives and financing options by contacting us today. We would be happy to assess your home and provide you with a quote from the highest-rated solar installer in the United States!

FAQs Texas Solar Incentives

Yes. While direct homeowner tax credits for purchased systems expire after 2025, third-party owned systems like PPAs can still qualify for federal incentives that your provider passes on to you.

When you buy solar, you own the system and previously claimed the tax credit yourself. With a PPA, a provider owns the system and you pay for the energy it generates, using the provider’s tax benefit to lower your rate.

Get a Quote: