Solar energy is a wise investment for homeowners. Thanks to the Inflation Reduction Act of 2023, solar tax credits encourage the switch to solar power, delivering quicker savings. The act extended solar tax credits for residential properties to encourage homeowners to switch to solar power. With these solar incentives, a new solar energy system will likely deliver significant savings to you even quicker than before.

Take a look at our quick guide to understand what this means for you – and why you should take advantage of these credits and make the switch today.

What the Inflation Reduction Act of 2023 Means for Solar Energy

Under the Inflation Reduction Act of 2023, homeowners can receive a 30% tax credit for specific energy-efficient home upgrades. The IRS states: “Beginning January 1, 2023, the amount of the credit is equal to 30% of the sum of amounts paid by the taxpayer for certain qualified expenditures, including (1) qualified energy efficiency improvements installed during the year, (2) residential energy property expenditures during the year, and (3) home energy audits during the year.”

In plain terms, this means that when you pay for certain energy-efficient upgrades to your home, like a solar energy system, the IRS will reward you by reducing your taxes by an amount equal to up to 30% of what you paid for the upgrade. That’s money going back into your pocket on top of the savings you can expect simply from switching to solar energy.

There are many different ways to qualify for this tax credit. For instance, choosing ENERGY STAR products can save you money and contribute to a sustainable future. ENERGY STAR products that help you to upgrade your home sustainably include the following:

- Air Source Heat Pumps

- Central Air Conditioners

- Boilers

- Biomass Fuel Stoves

- Furnaces

- Heat Pump Water Heaters

- Solar Energy Systems

Tax Credits for Solar Energy Systems

Solar systems are perhaps one of the most worthwhile investments you can make for your wallet and for the environment. Solar tax credits for upgrades placed in service after December 31, 2021, and before January 1, 2033, are 30%. Whether you’d like solar panels on a new or existing home, you can take advantage of this incredible tax credit along with years of reliable energy. Plus, thanks to this generous tax credit, your system will likely pay for itself more quickly.

Tax Credits for Battery Storage Systems

The Inflation Reduction Act of 2023 allows more battery storage technology to count toward your tax credit! To qualify, you must purchase battery storage with a capacity of 3 kilowatt-hours or greater. If you would like to add battery storage, Good Faith Energy can help you find products to ensure your tax credit eligibility. We can help you take advantage of these credits whether you’re expanding or installing a new system.

Solar Tax Credit Eligibility

To qualify for tax credits under this new law, the elements in question need to meet very specific requirements. Doors, windows, skylights, insulation, and battery storage need to meet or exceed certain energy standards.

While there is no overall dollar limit for the property credit, it is limited to 30% of the eligible spending from the tax year in question. Per the IRS: “… the credit allowed for fuel cell property expenditures is 30% of the expenditures up to a maximum credit of $500 for each half kilowatt of capacity of the qualified fuel cell property.” Our team (and your tax professional) can help you determine what that means for you and how you should upgrade to take the most advantage of this tax credit.

How to Claim Your Tax Credit

To claim your tax credit, you need to fill out IRS form 5695. This will be included in your tax return for the year you installed solar panels or other ENERGY STAR products. Your tax professional can help you with this and any other forms you’ll need to qualify for the credit.

How to Get Started

Fortunately, you don’t need to be a tax or solar panel expert to enjoy the tax benefits of energy-saving products. At Good Faith Energy, we stay informed about solar tax credit options and can help guide you through the process, from identifying which products work best for your home and providing professional solar installation to teaching you how to use a solar energy bank. While we aren’t tax professionals and can’t assist you in preparing your taxes directly, we can provide the receipts and other proof you’ll need to help you claim your tax credit.

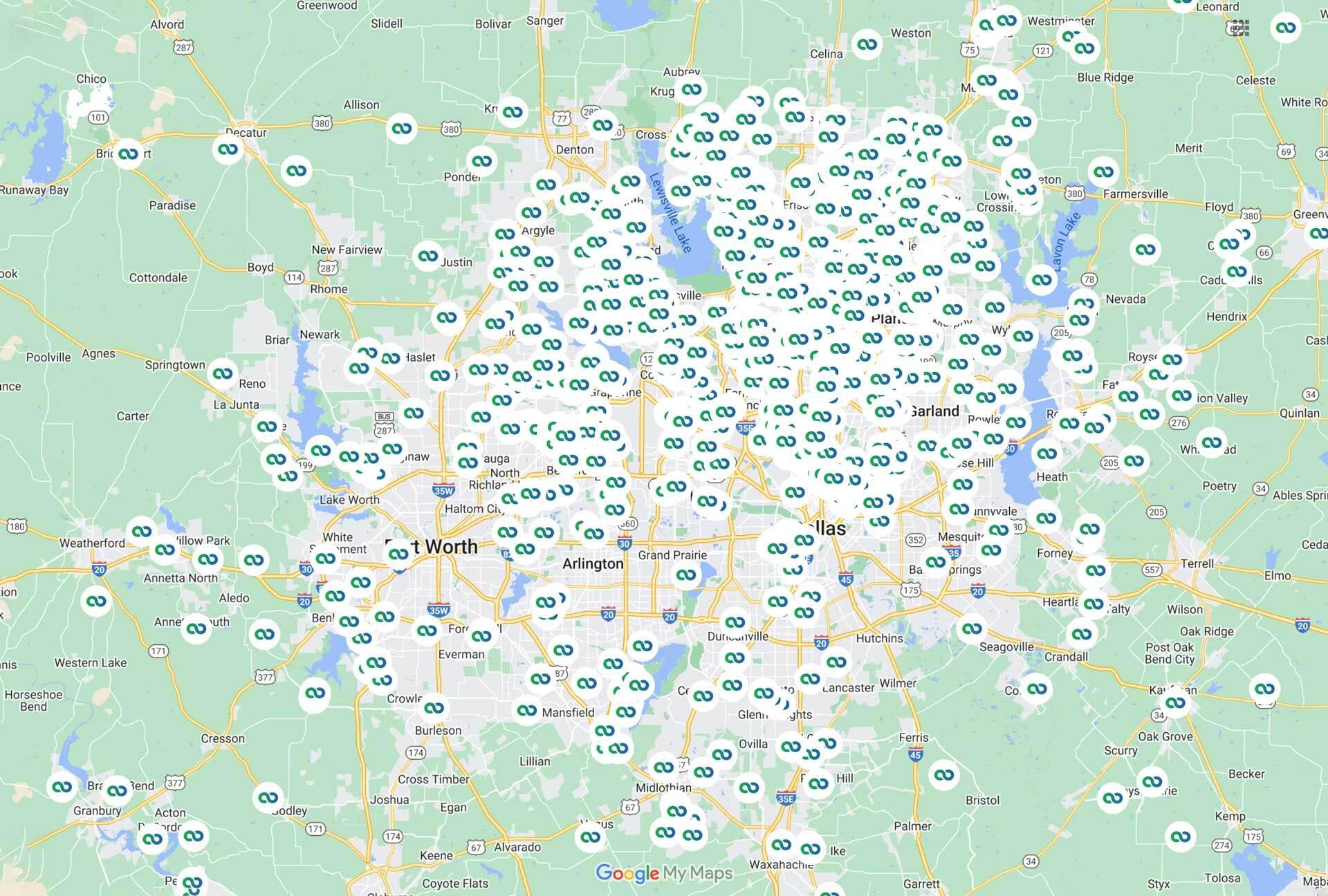

Contact us today to explore how the 2023 Inflation Reduction Act can influence your home upgrades. We proudly serve homeowners throughout Austin, Dallas, and Fort Worth, TX.

Fact checked by Jacob Petrosky – 4/26/2024